At UEDA 2023 was an impactful and busy year!

Perhaps you joined us at Carnival Milwaukee … or attended an Emerging Topics Series session … or visited our table at a community resource event … or participated in a Bank On or Take Root meeting.

Scroll down for more highlights from the year!

UEDA highlights include:

- Welcomed new Member Services Director Martha Collins.

- Said goodbye to our previous Trinity Fellow Kat Klawes and welcomed new Fellow Adam Bridges.

- Completed a new strategic plan for UEDA, to guide our work 2024-2026.

- Gained 20+ UEDA, Bank On Greater Milwaukee or Take Root Milwaukee members.

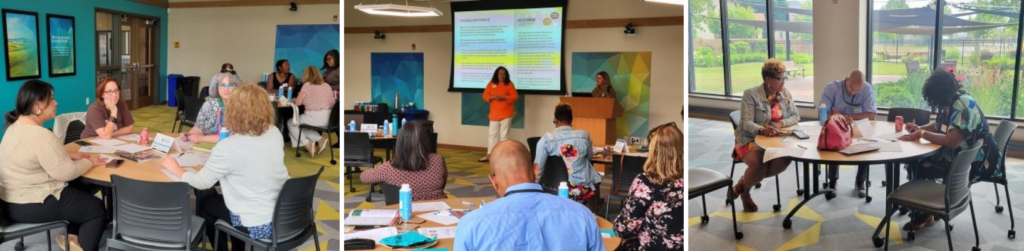

- Presented a great Emerging Topics series, partnering with Milwaukee Neighborhood News Service, MGIC, UW-Milwaukee, Milky Way Tech Hub, Latinos in Tech, and SEWRPC. Check out the Recap!

- Launched new training and development programs for City of Milwaukee community organizers and area financial counselors.

- Provided project support to Nonprofit Lift and Milwaukee Rental Housing Resource Center.

- Worked to formalize our partnership with the Nonprofit Academy of Wisconsin to provide technical assistance and organizational reviews to nonprofits.

- Met up with 60 our closest member friends at the Annual Community Gathering at Wall Street Stock Bar (check out the Instagram highlight reel).

- Increased our participation & outreach activity – this year we shared homeownership resources and financial education with over 850 people at 14 community events!

Our Take Root Milwaukee program:

- Developed a listing of Financial Coaching and Credit Counseling programs in Milwaukee.

- Fielded over 550 hotline calls for assistance and referrals to help people buy, fix, or keep a home.

- Working with IMPACT Connect to develop a system to better connect residents to home repair resources and services in the community.

- Successfully advocated for $2M for Down Payment Assistance (DPA) Program in 2024 City Budget.

Our Bank On Greater Milwaukee program:

- Was featured in the Cities for Financial Empowerment (CFE) Fund Skyline newsletter for a banking access pilot project we helped launch with youth aging out of foster care. Read it here!

- Connected with Employ Milwaukee / City of Milwaukee Earn and Learn Program to start offering banking access and financial education to youth employees in the summer job program.

- Worked with the WI Department of Corrections (DOC) and financial partners to offer banking access prior to release, use of penal system identification to open an account, and provide financial education resources to returning citizens.

- Began development of a NEW consumer-focused website (look for it in 2024!) and outreach materials for our partners to help educate people on pay apps and how to open a bank account.

Check out our Newsletter archive for additional updates, links, and resources.

We thank all of our Volunteers, Funders, Members, and Partners for their continued support of our work in community and economic development – we could not accomplish our mission without you!

Thank you for all we achieved together in 2023 and we look forward to continuing our collaborative work in 2024!